CASE STUDY # 1: Subject: CHANGING TACTICS IN A 1031 EXCHANGE MAY SAVE TAXES, or Why do a 1031 Exchange When You’ve Lost Money On a Deal?

My client invests as a family limited partnership entity. It originally invested $1,000,000 into a TIC property 10 years ago. The recent sale of the relinquished property resulted in sales proceeds of $546,540 before taxes. This represented a substantial loss. A number of investors in this situation would not have completed a 1031 exchange. They would have chosen to pay their taxes. If this entity had not entered into an exchange, the tax liability of approximately $465,000 would have reduced the original $1,000,000 investment to approximately $81,500, a 92% haircut.

The unfortunate situation is that investors often don’t analyze the tax implication of their situation until it is too late to structure meaningful taxation strategies. To fully defer taxes with a 1031 exchange, one has to acquire property with equal or greater debt, and use all of the money.

The client originally considered exchanging into multiple apartment DSTs with the $546,540. If the entity bought normally leveraged assets (e.g., 50% LTV) and used all of the money there would have been debt boot, which is taxable. In this case all of the money would have used, but there would still be a tax liability of about $210,000. To avoid debt-boot the client needed to buy an asset with very high leverage to satisfy the equal or greater debt provision to fully defer taxable gain.

Once I established the basis, I calculated the required allocation into a highly leveraged, Zero-Coupon, 1031 replacement property to offset debt and assist with full deferral of taxable liability. “Highly leveraged” means as assets increase in leverage (a greater percentage of debt to equity) the debt level can get high enough that there is no cash flow. That’s the maximum leverage that can be obtained. Zero-Coupon assets are often levered with a debt coverage ratio of one-to-one. In other words, income from the property is equal to the mortgage payment. There is no income.

Since this was a substantial departure from the client’s intended approach, I asked for and was granted permission with speak to her CPA because I focus on the tax consequences of all structured investment strategies. The CPA verified and supported my analysis and conclusions. I discussed my findings with my client who, after consulting with her CPA, agreed with and executed my proposed tax deferral plan.

The zero coupon holding period is expected to be 8-10 years. My client needs to get an additional $450k back to be made whole in absolute dollars. Over time the mortgage pays down the principal balance while the value of the asset remains constant. With the mortgage pay down, my client has the ability to be made whole.

The net effect from the overall transaction was that with anticipated mortgage pay down of the Zero-Coupon asset, my client could recover most, or all of the dollars lost in the previous transaction. I’m now completing my second set of exchanges for this client, and her CPA is referring me business.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on collaboration with a tax professional. This example was in accordance of the applicable laws at the time of the transaction.

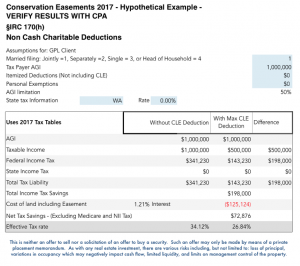

CASE STUDY # 2: USING CHARITABLE CONTRIBUTIONS OF A CONSERVATION EASEMENT, IRC § 170(h); A tax-mitigation Strategy for Ordinary Income

A Charitable Contribution of a Conservation Easement (CE) may be used to mitigate taxes due to ordinary income.

A CE can occur when a property owner gives up a viable right (such as a development, or a mineral right, etc.) associated with a property in perpetuity, via easement, that is monitored by an NGO or government entity, as long as it creates a public benefit.

The CE is structured as a real estate investment that has three operational and exit strategies one of which is voted to be the strategy that will be used by the investors. Generally, the strategies are:

- Hold the property for appreciation,

- Develop the property to its highest and best use, or

- Create a Conservation Easement.

To determine the value of the conservation easement, two MAI appraisals of the subject property, meeting specific governmental criteria, are completed: the first appraisal is the before condition of the property’s highest and best use, the second is the after condition of the property’s highest and best use. The difference in value between the first and second appraisal may provide a tax deduction to the investor.

The tax benefits generated by a Conservation Easement are limited to 50% of adjusted gross income (AGI). Historically, the economics of a CE are such that for a $1 contribution into the CE, an investor’s income is reduced by approximately $4.00. At a 39.6% tax rate, for every $1 contributed, the investor’s taxes may be reduced by approximately $1.60.

It should be noted the IRS is aware that Conservation Easements are subject to abuse because of the tax benefits received. The IRS put forth Notice 2017-10 January 23, 2017 to address these issues. CEs are now listed transactions. In the event the deduction is equal or greater than 250% of the amount invested, they are subject to further scrutiny and potential audit as being abusive. The CEs referenced in this case study have a deduction of approximately 1.6 to 1. Furthermore, in an abundance of caution, the sponsor has recently sought to get tax loss insurance on all CEs going forward. They have been successful in obtaining that insurance for all CEs since that decision.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on collaboration with a tax professional. This example was in accordance of the applicable laws at the time of the transaction.

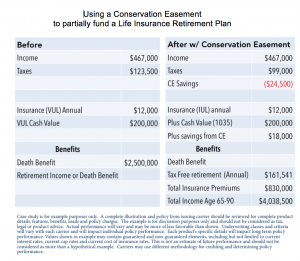

CASE STUDY # 3: REDEPLOYING TAX SAVINGS FROM A CONSERVATION EASEMENT TO PROVIDE TAX FREE RETIREMENT INCOME

A married couple in their mid-forties approached me to have a financial analysis based on my Strategic Tax Mitigation™ protocol. Their chief concerns included: the lack of strategies they had to reduce their current taxes and to develop a better retirement income program. After the review, I developed a plan to meet the clients’ goals and objectives.

- The clients currently generate approximately $467,000 annual income.

- The clients each have older Variable Universal Life (VUL) Insurance policy

With regards to income, a Charitable Contribution of a Conservation Easement (IRC § 170h) could be used to reduce taxes due to Ordinary Income (see Conservation Easement case study). In this couple’s case, a tax savings of approximately $24,500/yr could be achieved. Using this strategy, their taxes could be reduced from $123,500 to $99,000 in the proposal year.

With regards to their life insurance policies, Variable Universal Life policies follow the market. Cash values in the policy can go up or down depending on the direction of the market. When I explained the volatility issues the clients also became concerned. The policies were out of date and didn’t meet the clients’ desire for creating additional income in retirement.

The following proposal was made:

Generate tax savings from the use of the conservation easement, then redeploy the savings to invest in a better life insurance policy. The tax savings from the Conservation Easement could be used to help create a life insurance policy more aligned with the clients’ goals and objectives.

The existing VUL insurance policy was converted into an Indexed Universal Life (IUL) insurance policy by using a IRC § 1035 exchange. The clients were lawfully able to make this exchange without paying taxes. The two VUL policies had a cash value of approximately $200,000. The annual $12,000 premium for both clients was increased by $18,000 for a total of $30,000/yr, using most of the annual savings from the Conservation Easement. The CE acquisition and tax savings is repeated annually. As long as the couple’s income stays above $400,000, the new life insurance policy should be fundable from the Conservation Easement savings, with no additional money from the clients.

Through the Indexed Universal Life policies, the clients may be able to create $161,541 per year tax-free retirement income for 25 years (65 to 90). The total cost of the policies is $830,000. If the clients survive for just over 5 years into retirement, they will have gotten their money back. If the clients live long enough to use all of the tax-free income available in the policy, they should be able to withdraw over $4,038,500, or nearly 5 times their cost.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on collaboration with a tax professional. This example was in accordance of the applicable laws at the time of the transaction.

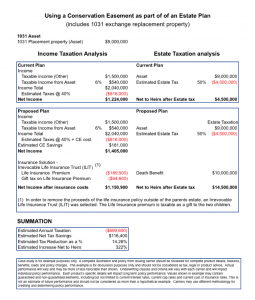

CASE STUDY # 4: A 1031 EXCHANGE THAT BECAME A CONSERVATION EASEMENT TO FUND PART OF AN ESTATE PLAN FOR ESTATE TAX OFFSET

In a recent consultation, a high net worth individual told me he inherited property in the middle of the country. The property was worthless until they found oil. He received an offer on the property, the net price of which was $9,000,000. The client was interested in deferring his taxable gain.

He was not happy about the value and sale because of the tax consequences. He had gifted to his children the maximum amount allowed. So, instead of a $9 million gain he had created a $4,500,000 tax liability for his heirs.

Using the following assumptions:

- The couple’s income of $1,500,000 was increased by $540,000 following the acquisition of the 1031 replacement property, for a total annual income of $2,040,000.

- Husband and wife are both in their early 70s.

The following proposal was made:

- By using a Charitable Contribution of a Conservation Easement to offset ordinary income, the estimated annual tax savings was approximately $181,000.

- The $181,000 tax savings in combination with an additional $8,500 for a total of $189,500 was used to purchase a Second-to-Die, Indexed Universal Life insurance policy. The policy had a death benefit of approximately $10,000,000.00.

- The insurance policy was structured as an Irrevocable Life Insurance Trust ILIT to get the policy proceeds outside of their estate. This created an additional gift tax on the premium.

The net result was that for nominal costs to the couple, their heirs could receive sufficient proceeds to offset the original estate tax liability as well as leaving their heirs with an additional $5,500,000 that could be used to offset further growth in the parent’s estate.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on collaboration with a tax professional. This example was in accordance of the applicable laws at the time of the transaction.

CASE STUDY # 5: TAX-ADVANTAGED INVESTING

CLIENT: A high net worth business owner with a significant income stream who is starting to explore estate-planning issues.

STRATEGY: The client owned two adjacent commercial properties in a major metropolitan area. One of the properties was purchased to develop and relocate the client’s expanded business. It was eventually deemed surplus and sold via a 1031 exchange. Due to the financing, all loans were paid off at closing leaving relatively small amount of sales proceeds before taxes. Since the lender agreed to refinance the retained property to the same debt level as before the exchange, funds were available not only to complete the exchange, but additional funds remained for further investment.

After reviewing the client’s tax returns in collaboration with her CPA, we determined that the additional funds could be used to: reduce the client’s effective marginal tax rate, and fund a plan that would produce tax free retirement income. An analysis showed her effective marginal tax rate could be reduced from 33.7% to 21.1% with a tax savings of $132,700.

A substantial portion of this strategy could be replicated annually, as long as tax regulations remain relatively consistent. The first area of interest was ordinary income. The solution involved the use of a charitable contribution (IRC Section 170h) to directly impact taxes at the ordinary income level. The next area of interest was rental and royalty income. The solution involved the use of depreciable assets to minimize the impact of rental income.

RESULTS: The client was able to reduce her effective marginal tax rate and realize substantial tax savings as a result of employing the recommended solutions. Furthermore, the client redeployed the savings into an insurance based retirement plan that, upon full funding of the program, would provide tax free retirement income for life.

By using assets that are not well known, and are typically non-public, we target specific areas of the tax code and take maximum advantage of those codes for the benefit of and in conjunction with a client’s specific financial objectives. Read more about Conservation Easements.

As with any tax strategy, clients should consult with their tax professional. Neither IREXA, LLC nor Great Point Capital are attorneys or tax professionals. All work regarding Strategic Tax Mitigation™ relies on collaboration with a tax professional. This example was in accordance of the applicable laws at the time of the transaction.